Bank of Nova Scotia Has $4.59 Million Stake in Synchrony Financial (SYF)

Bank of Nova Scotia reduced its holdings in shares of Synchrony Financial (NYSE:SYF) by 81.0% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 195,914 shares of the financial services provider’s stock after selling 836,929 shares during the quarter. Bank of Nova Scotia’s holdings in Synchrony Financial were worth $4,594,000 at the end of the most recent reporting period.

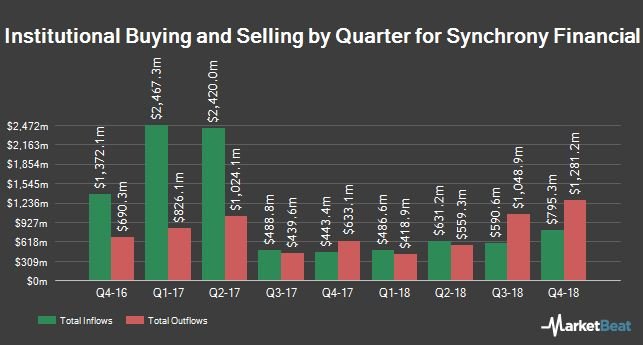

Other hedge funds and other institutional investors have also modified their holdings of the company. Enlightenment Research LLC acquired a new position in shares of Synchrony Financial during the fourth quarter valued at about $28,000. Taylor Hoffman Wealth Management purchased a new position in Synchrony Financial during the fourth quarter worth about $39,000. Dubuque Bank & Trust Co. purchased a new position in Synchrony Financial during the fourth quarter worth about $43,000. Huntington National Bank boosted its holdings in Synchrony Financial by 47.6% during the fourth quarter. Huntington National Bank now owns 1,908 shares of the financial services provider’s stock worth $45,000 after purchasing an additional 615 shares during the last quarter. Finally, Oregon Public Employees Retirement Fund boosted its holdings in Synchrony Financial by 2,218.5% during the fourth quarter. Oregon Public Employees Retirement Fund now owns 1,810,995 shares of the financial services provider’s stock worth $77,000 after purchasing an additional 1,732,885 shares during the last quarter. Hedge funds and other institutional investors own 82.47% of the company’s stock.

In other news, insider David P. Melito sold 3,934 shares of the business’s stock in a transaction that occurred on Thursday, January 31st. The shares were sold at an average price of $30.00, for a total value of $118,020.00. Following the sale, the insider now owns 29,486 shares of the company’s stock, valued at $884,580. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, insider David P. Melito sold 3,204 shares of the business’s stock in a transaction that occurred on Thursday, January 24th. The shares were sold at an average price of $30.00, for a total transaction of $96,120.00. Following the completion of the sale, the insider now directly owns 40,313 shares in the company, valued at approximately $1,209,390. The disclosure for this sale can be found here. In the last ninety days, insiders sold 60,342 shares of company stock worth $1,966,668. Insiders own 0.07% of the company’s stock.

Shares of SYF stock opened at $32.22 on Wednesday. The stock has a market capitalization of $22.63 billion, a price-to-earnings ratio of 8.61, a P/E/G ratio of 0.81 and a beta of 1.27. The company has a debt-to-equity ratio of 1.63, a quick ratio of 1.40 and a current ratio of 1.41. Synchrony Financial has a 52 week low of $21.77 and a 52 week high of $37.57.

Synchrony Financial (NYSE:SYF) last announced its quarterly earnings data on Wednesday, January 23rd. The financial services provider reported $1.09 EPS for the quarter, topping the consensus estimate of $0.93 by $0.16. The business had revenue of $4.40 billion for the quarter, compared to analyst estimates of $4.25 billion. Synchrony Financial had a net margin of 15.45% and a return on equity of 19.41%. During the same quarter in the previous year, the firm posted $0.70 earnings per share. Research analysts predict that Synchrony Financial will post 4.37 earnings per share for the current year.

The business also recently disclosed a quarterly dividend, which was paid on Thursday, February 14th. Shareholders of record on Monday, February 4th were given a $0.21 dividend. This represents a $0.84 annualized dividend and a yield of 2.61%. The ex-dividend date was Friday, February 1st. Synchrony Financial’s dividend payout ratio is 22.46%.

SYF has been the topic of several analyst reports. Oppenheimer upgraded shares of Synchrony Financial from a “market perform†rating to an “outperform†rating and set a $43.00 price target on the stock in a report on Thursday, January 24th. Bank of America upgraded shares of Synchrony Financial from a “neutral†rating to a “buy†rating and set a $37.00 price target on the stock in a report on Wednesday, January 30th. Zacks Investment Research cut shares of Synchrony Financial from a “buy†rating to a “hold†rating in a report on Tuesday, January 29th. Stephens upgraded shares of Synchrony Financial from an “underweight†rating to an “equal weight†rating in a report on Thursday, January 3rd. Finally, TheStreet cut shares of Synchrony Financial from a “b-†rating to a “c+†rating in a report on Monday, November 19th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating and nine have issued a buy rating to the company’s stock. Synchrony Financial has an average rating of “Hold†and a consensus price target of $37.73.

Synchrony Financial Company Profile

Synchrony Financial operates as a consumer financial services company in the United States. The company offers private label credit cards, dual cards, general purpose co-branded credit cards, and small and medium-sized business credit products; and promotional financing for consumer purchases, such as private label credit cards and installment loans.

Comments

There are 0 comments on this post