Canadian Natural Resources’ (CNQ) Buy Rating Reaffirmed at Royal Bank of Canada

Canadian Natural Resources (NYSE:CNQ) (TSE:CNQ)‘s stock had its “buy†rating reaffirmed by Royal Bank of Canada in a research note issued to investors on Tuesday.

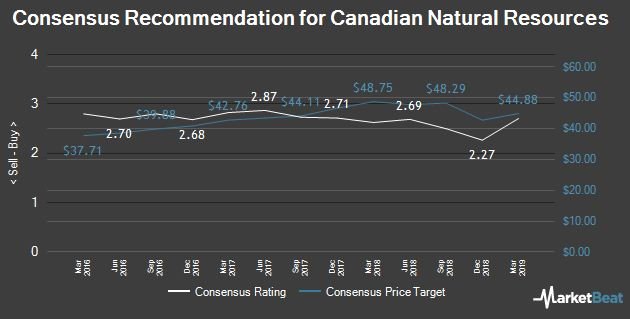

A number of other analysts have also recently issued reports on the stock. ValuEngine cut shares of Canadian Natural Resources from a “hold†rating to a “sell†rating in a research note on Tuesday. Zacks Investment Research raised shares of Canadian Natural Resources from a “strong sell†rating to a “hold†rating in a research note on Monday, February 11th. Raymond James reissued a “buy†rating on shares of Canadian Natural Resources in a research note on Friday, February 8th. CIBC reissued a “buy†rating on shares of Canadian Natural Resources in a research note on Saturday, February 2nd. Finally, Morgan Stanley reissued a “buy†rating on shares of Canadian Natural Resources in a research note on Tuesday, January 29th. One analyst has rated the stock with a sell rating, two have assigned a hold rating and twelve have issued a buy rating to the company’s stock. The company currently has an average rating of “Buy†and an average target price of $43.86.

Shares of NYSE CNQ traded up $0.02 during midday trading on Tuesday, reaching $27.30. The stock had a trading volume of 282,265 shares, compared to its average volume of 2,833,050. The company has a debt-to-equity ratio of 0.58, a current ratio of 0.92 and a quick ratio of 0.69. The stock has a market cap of $32.81 billion, a PE ratio of 32.89, a price-to-earnings-growth ratio of 5.00 and a beta of 1.21. Canadian Natural Resources has a 12-month low of $21.85 and a 12-month high of $38.20.

Several institutional investors have recently modified their holdings of the company. Comerica Bank lifted its stake in Canadian Natural Resources by 9.2% during the 3rd quarter. Comerica Bank now owns 88,547 shares of the oil and gas producer’s stock valued at $2,490,000 after acquiring an additional 7,484 shares during the period. Mn Services Vermogensbeheer B.V. boosted its position in shares of Canadian Natural Resources by 2.7% during the 3rd quarter. Mn Services Vermogensbeheer B.V. now owns 197,118 shares of the oil and gas producer’s stock worth $8,318,000 after purchasing an additional 5,200 shares in the last quarter. Janney Montgomery Scott LLC boosted its position in shares of Canadian Natural Resources by 6.7% during the 3rd quarter. Janney Montgomery Scott LLC now owns 57,027 shares of the oil and gas producer’s stock worth $1,863,000 after purchasing an additional 3,574 shares in the last quarter. Dividend Assets Capital LLC boosted its position in shares of Canadian Natural Resources by 3.0% during the 3rd quarter. Dividend Assets Capital LLC now owns 63,241 shares of the oil and gas producer’s stock worth $2,065,000 after purchasing an additional 1,856 shares in the last quarter. Finally, JPMorgan Chase & Co. boosted its position in shares of Canadian Natural Resources by 40.7% during the 3rd quarter. JPMorgan Chase & Co. now owns 2,319,729 shares of the oil and gas producer’s stock worth $75,761,000 after purchasing an additional 670,665 shares in the last quarter. 67.80% of the stock is currently owned by hedge funds and other institutional investors.

About Canadian Natural Resources

Canadian Natural Resources Limited explores for, develops, produces, and markets crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen, and synthetic crude oil (SCO). Its midstream assets include two crude oil pipeline systems; and a 50% working interest in an 84-megawatt cogeneration plant at Primrose.

Further Reading: How do candlesticks reflect price movement?

Receive News & Ratings for Canadian Natural Resources Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for Canadian Natural Resources and related companies with

Comments

There are 0 comments on this post