Toronto Dominion Bank Reduces Holdings in Sun Life Financial Inc (SLF)

Toronto Dominion Bank trimmed its holdings in shares of Sun Life Financial Inc (NYSE:SLF) (TSE:SLF) by 61.0% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 2,983,856 shares of the financial services provider’s stock after selling 4,663,082 shares during the period. Toronto Dominion Bank owned 0.50% of Sun Life Financial worth $99,896,000 as of its most recent SEC filing.

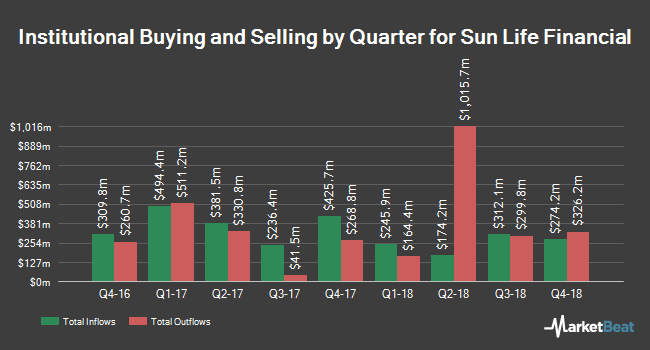

Other large investors have also modified their holdings of the company. Enlightenment Research LLC acquired a new stake in shares of Sun Life Financial during the fourth quarter worth $33,000. Lindbrook Capital LLC acquired a new stake in shares of Sun Life Financial in the 4th quarter worth about $36,000. We Are One Seven LLC acquired a new stake in shares of Sun Life Financial in the 4th quarter worth about $53,000. Csenge Advisory Group acquired a new stake in shares of Sun Life Financial in the 3rd quarter worth about $116,000. Finally, Advisors Asset Management Inc. increased its holdings in shares of Sun Life Financial by 16.6% in the 4th quarter. Advisors Asset Management Inc. now owns 3,188 shares of the financial services provider’s stock worth $106,000 after acquiring an additional 455 shares during the period. 41.07% of the stock is currently owned by institutional investors.

SLF has been the topic of a number of analyst reports. Barclays reaffirmed a “buy†rating on shares of Sun Life Financial in a report on Friday, November 9th. Argus raised shares of Sun Life Financial from a “hold†rating to a “buy†rating in a report on Monday, December 31st. They noted that the move was a valuation call. CIBC reaffirmed an “average†rating and issued a $53.00 price objective on shares of Sun Life Financial in a report on Thursday, December 20th. Scotiabank cut shares of Sun Life Financial from a “sector outperform†rating to a “sector perform†rating in a report on Wednesday, February 6th. Finally, Canaccord Genuity reaffirmed a “hold†rating on shares of Sun Life Financial in a report on Tuesday, February 5th. Two research analysts have rated the stock with a sell rating, four have issued a hold rating and four have given a buy rating to the stock. The stock currently has a consensus rating of “Hold†and a consensus target price of $51.50.

Shares of SLF stock traded up $0.37 during trading hours on Wednesday, reaching $37.47. The stock had a trading volume of 14,109 shares, compared to its average volume of 509,838. Sun Life Financial Inc has a twelve month low of $31.49 and a twelve month high of $43.99. The stock has a market cap of $22.20 billion, a PE ratio of 9.99 and a beta of 0.86.

Sun Life Financial (NYSE:SLF) (TSE:SLF) last announced its earnings results on Wednesday, February 13th. The financial services provider reported $1.19 earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of $0.87 by $0.32. The firm had revenue of $8.18 billion during the quarter, compared to analyst estimates of $6.28 billion. Sun Life Financial had a net margin of 9.71% and a return on equity of 13.48%. Sun Life Financial’s revenue was down 5.4% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $1.05 EPS. On average, analysts expect that Sun Life Financial Inc will post 3.78 earnings per share for the current fiscal year.

The business also recently announced a quarterly dividend, which will be paid on Friday, March 29th. Investors of record on Friday, March 1st will be given a $0.381 dividend. This represents a $1.52 dividend on an annualized basis and a yield of 4.07%. The ex-dividend date is Thursday, February 28th. This is a positive change from Sun Life Financial’s previous quarterly dividend of $0.38. Sun Life Financial’s dividend payout ratio is currently 40.53%.

About Sun Life Financial

Sun Life Financial Inc, a financial services company, provides insurance, wealth, and asset management solutions to individuals and corporate clients, high-net-worth individuals, and families. It operates through Sun Life Financial Canada, Sun Life Financial United States, Sun Life Financial Asset Management, Sun Life Financial Asia, and Corporate segments.

Read More: Purposes and Functions of the Federal Reserve

Want to see what other hedge funds are holding SLF? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Sun Life Financial Inc (NYSE:SLF) (TSE:SLF).

Comments

There are 0 comments on this post